When purchasing a new home, the down payment is not all you have to bring to the closing table. Every transaction will come with closings costs. These costs get paid to the lender, title company, state, and city municipalities at the closing of a real estate transaction.

Closing costs can often be intimidating and understanding what you are paying for can take some stress out of the transaction. Here is some info on what to expect:

How much are closing costs?

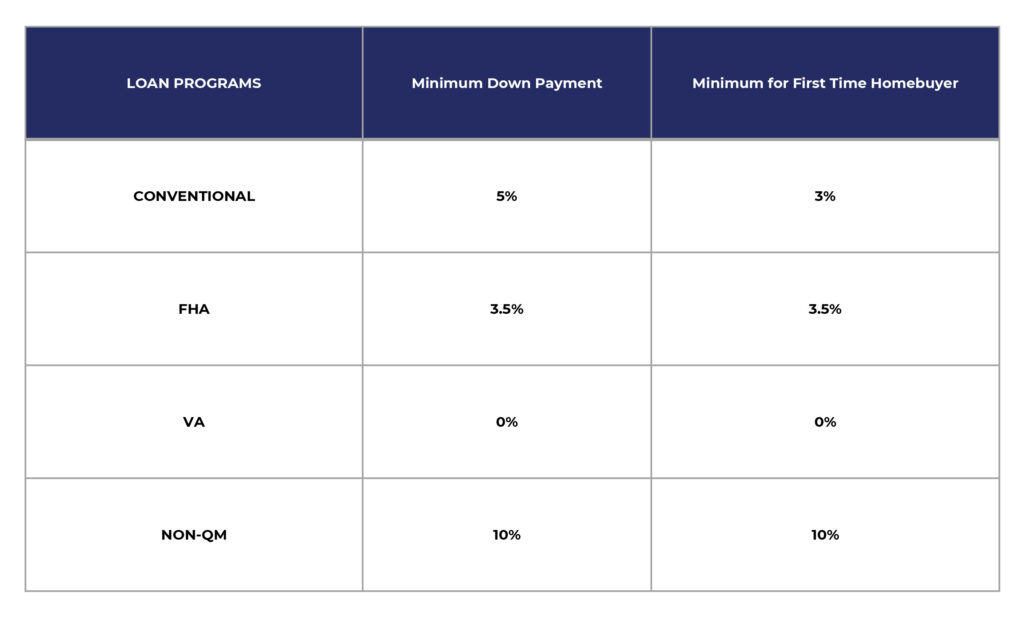

Closing costs typically range anywhere from 2% – 6% of the home’s value. Meaning a $300,000 home can have closing costs ranging from $6,000 – $18,000. These closing costs do not include the down payment. Minimum down payments per loan program are:

This means the total cost for a conventional loan, for a first-time homebuyer with a strong credit score, on that same $300,000 house can range from $15,000 to $27,000 after down payment and closing costs are applied. Non-first-time homebuyers with lower credit scores can expect to pay more.

Who has to pay these costs?

Typically, the buyer must come out of pocket to cover most costs however, there are other options:

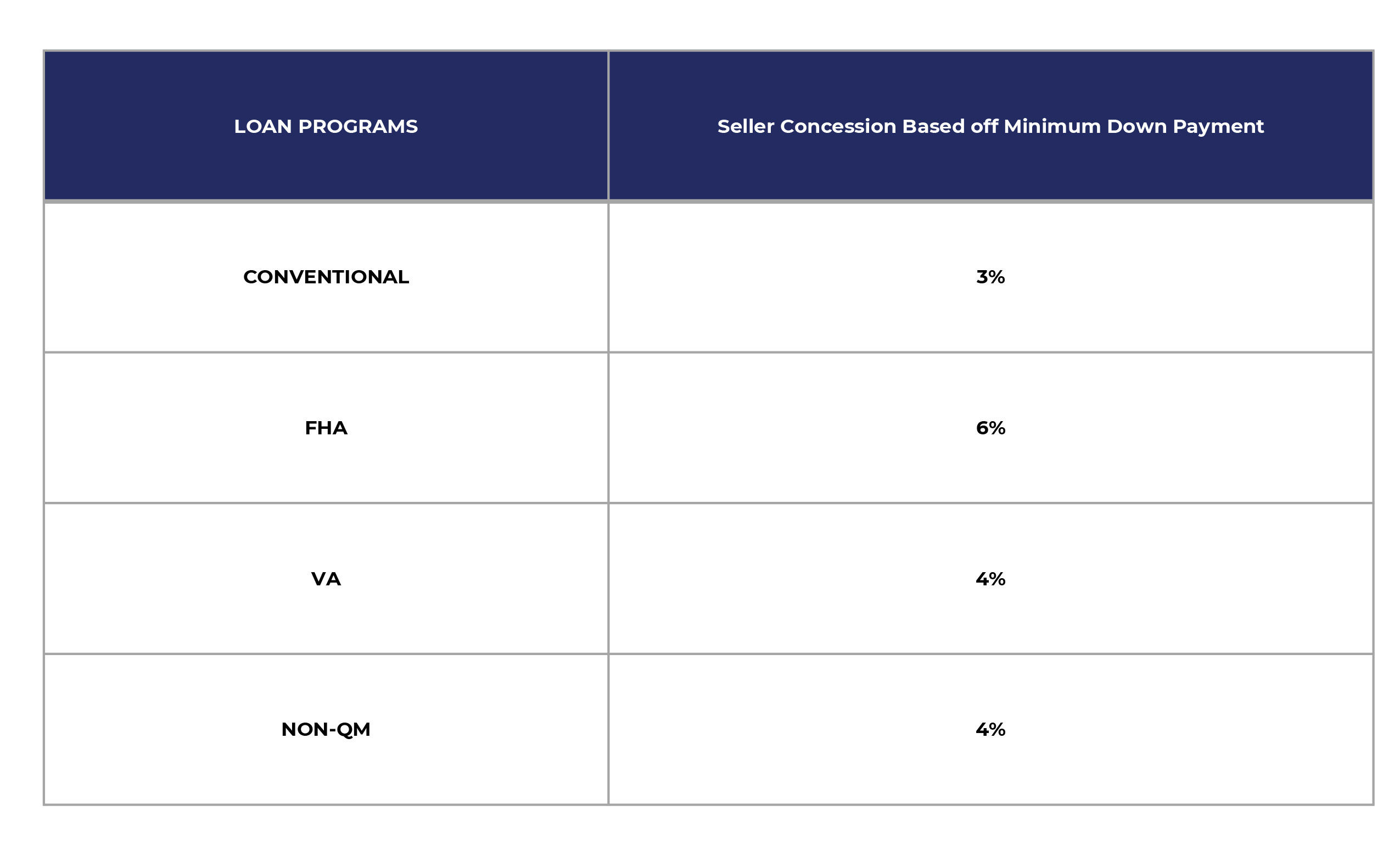

- Seller concessions allow sellers to credit the buyer money to help cover closing costs – these credits are limited by program type (based off of minimum down payments):

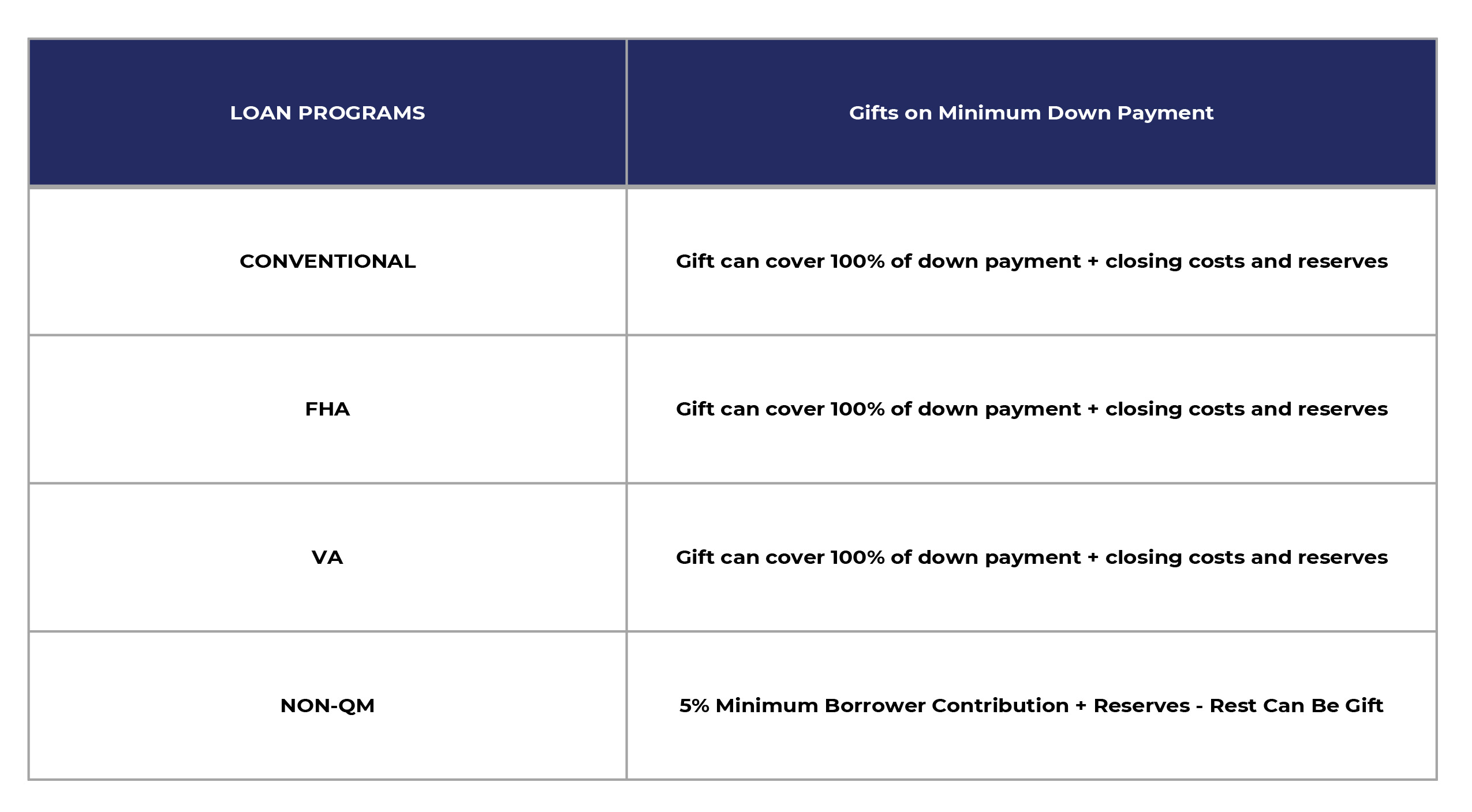

2. Gifts can come from family members, employers, or religious entities and cover a percentage of the transactions closing cost and down payment.

3. Down payment and closing cost assistance – More on this coming soon!

Where can you find your closing costs?

Closing costs will be conveyed on two forms – the loan estimate and the closing disclosure. Both forms will break down the costs in a similar manner. Closing costs fall into three main categories: lender fees, third-party fees, and prepaid items, here is what you can expect:

Lender Fees:

Discount Points: Borrowers can buy a lower interest rate the cost to do so will be reflected as discount points – 1pt = 1% of the loan amount.

Underwriting Fee: The cost to underwriter the loan.

Processing Fee: The cost to process the loan.

Third Party Fees

Appraisal: The cost to order an appraisal – every appraisal most be ordered by the lender through a third party.

Credit Report Fees: Costs to obtain credit reports and any other credit related services from the three credit bureaus.

Tax Related Service Fee: Ensures property taxes are paid on time.

Flood Cert: Cost to purchase a flood cert to determine the properties flood zone.

Lenders Title Insurance: Repays the lender if you lose your home due to a title fault.

Owners Title Insurance: Protects you, the buyer, if there is a title fault on the home.

Misc. Title Fees: Title companies will charge several additional fees for title processing including but not limited to: Settlement Fees, Title Search Fees, Courier Fees, and more.

Survey Fee: The cost to purchase a survey of your property.

Recording Fees: Fee that is paid to your local city or country clerk to update and record the mortgage information.

Transfer Tax: Local government charges that occur with the transfer of title.

State & City Stamps: Additional government charges that occur with the recording of a new mortgage.

Prepaids

Homeowners Insurance: Homeowners insurance get paid up front and covers the following 12 months.

Mortgage Insurance Premium: Typically, only seen with FHA financing a mortgage insurance premium is an upfront fee paid to insure the mortgage. The FHA finances this fee for you over the life of the loan, so there is no additional upfront cost.

Prepaid interest: Monthly mortgage payments cover interest in arrears (that has already accumulated) however, prepaid mortgage interest gets paid for the remaining days of the current month. That means your first mortgage payment will not be until the first day of the following month.

Escrows (optional on Conventional loans with 20% down or more):

Property taxes: An escrow account collects a portion of your property taxes each month so when taxes are due, they can automatically be paid.

Homeowners Insurance: Just like property taxes an escrow account collects a portion of your homeowners’ insurance each month so when your insurance payment is do it can be processed automatically.

Other:

HOA Fees, Home Warranties, and numerous other fees can appear on the other sections; however, these feels should not come as a surprise and are usually explained on the purchase contract and by your real estate agent prior to going under contract.

If you would like to learn more about reading a closing disclosures you can find more information on the CFPB website or by contacting a Lendz Financial mortgage professional.