In today’s housing market, demand is extremely high, and supply is low. Freddie Mac (the second largest mortgage loan servicer in the country) estimates the US is 4 million homes short of being able to meet home buyer demand, this means presenting a strong purchase offer to a seller is crucial. While submitting a cash offer is the best way to, “wow” a seller, upfront underwriting is a close second.

What is a pre-qualification?

When one begins their search for a home, the first step is typically understanding how much financing they qualify for. Speaking to a loan originator is the best way to understand what that maximum loan amount is, and a pre-qualification is the first step in that process.

A typical conversation will include:

How much to do you make?

How much do you have available for a down payment?

What is your credit score?

Do you have any debt?

Questions like these will give a loan officer a good idea as to what one’s buying power is, but without supporting documents a pre-qualification is pure speculation.

Are pre-approvals enough to feel confident?

Submitting an offer to purchase a home with just a pre-qualification can be hazardous and leave a borrower’s escrow at risk. Therefore, most mortgage professionals will complete a full pre-approval.

Pre-approvals require documents including:

- tax forms – W2s for wage earners, and full tax returns for self-employed borrowers

- paystubs for wage earners

- bank statements or retirement accounts showing cash to close

- credit report & documentation for any debts not appearing on the credit report

With these documents and an automated underwriting system, a loan officer is able to issue an accurate pre-approval.

*Automated underwriting systems (AUS) use advanced algorithms to determine mortgage eligibility, without an approval from AUS conventional and government loans are usually not possible. Exceptions do apply.

*Non-QM loans do not require AUS (learn more about Non-QM loans here).

A pre-approval from an experienced Lendz Financial mortgage professional can all but ensure a fast path to closing (appraisal, insurance, and title issues aside). The issue with a pre-approval is not every loan consultant, at every company, is an expert; and often, it can be difficult to differentiate the amateurs from the professions.

An unexperienced loan officer’s pre-approval can still leave a borrower’s escrow at risk and because of this, upfront underwriting might be the most important part of a mortgage transaction for the buyer and seller alike.

Remove any doubt with upfront underwriting.

Upfront underwriting takes all the documents needed for a pre-approval and places them in the hands of an underwriter. This extra step gives a borrower an official loan approval prior to the execution of a purchase agreement. A borrower can then present a confident offer and a seller is able to recognize a strong qualified buyer.

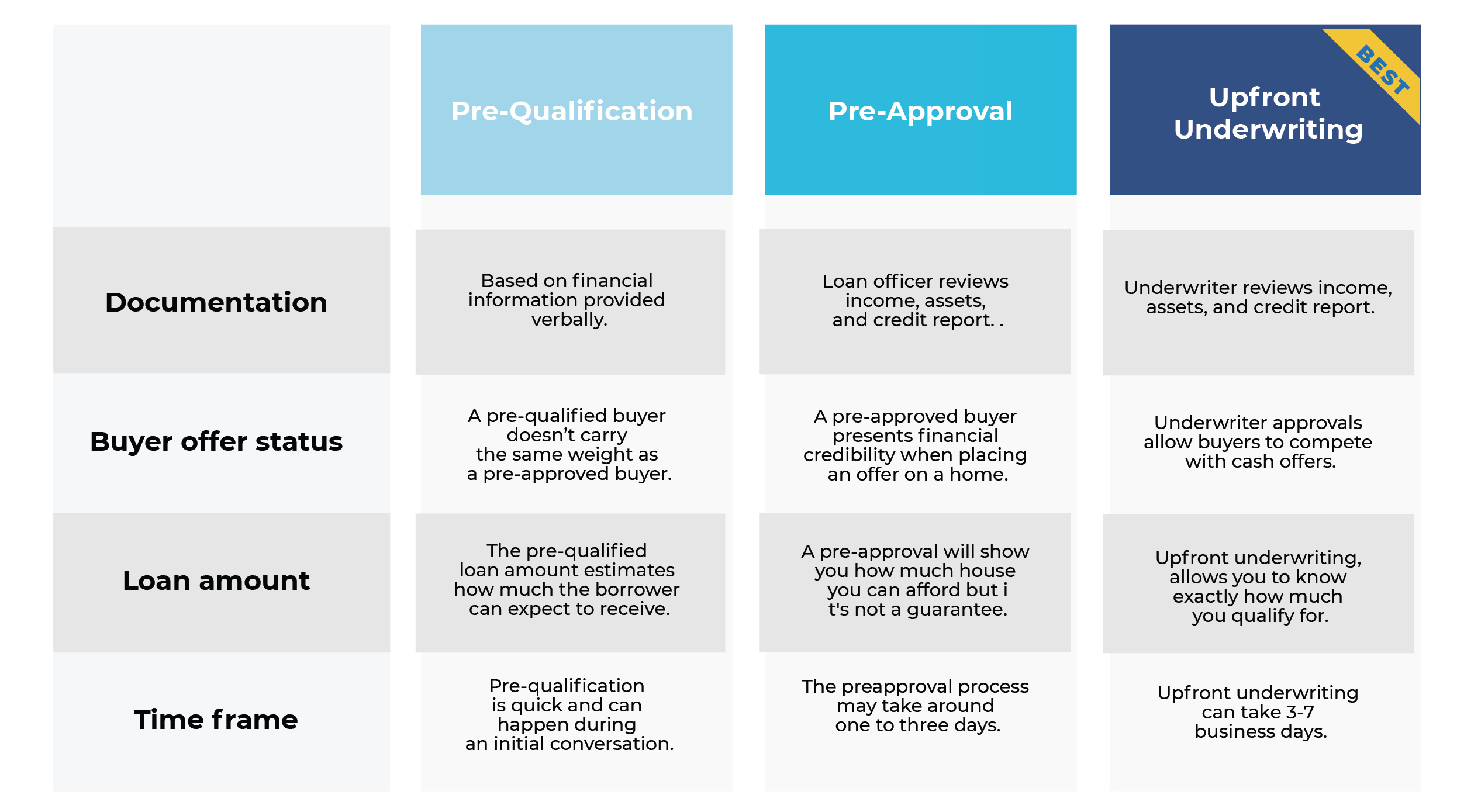

Below is a chart breaking down the different qualification methods:

Working with Lendz allows for upfront access to the underwriter. This special admission positions a home buyer for a fast risk-free purchase that can compete with cash offers. The underwriter will always make the final decision on a loan. Borrowers unsure of their purchasing power should always take advantage of upfront underwriting to mitigate risk and ensure qualification.